Navigating Virtual Data Room Structure: A Thorough Overview

According to Russel Bradley-Cook from HubSpot’s EMEA in Tech Partnerships, 20-30% questions in mergers and acquisitions come from bidders who cannot find the necessary documents. That number could be decreased dramatically thanks to an intuitive, logically built VDR structure.

Logical and well-thought-out structure of virtual data rooms (VDRs) not only helps all parties to navigate the virtual data room space effortlessly but also improves the collaboration and facilitates decision-making.

In this article, we’ll explore the concept of a virtual data room index, its impact on business transactions, and best practices for optimizing your data room organization. You’ll learn how a well-structured VDR index can ease managing VDR files, streamline due diligence, and bolster security. Keep reading!

Understanding data room index

A virtual data room index is an arrangement of documents, files, folders, and other relevant data, presented in a logical and hierarchical manner, within a secure online platform. It serves as a data room table of contents for authorized stakeholders involved in high-stakes transactions such as mergers, acquisitions, investments, audits, and legal proceedings.

The index acts as a digital roadmap that enables users to efficiently locate, review, and analyze pertinent information, thus streamlining decision-making processes while maintaining stringent data security protocols. To more easily understand how a data room index works, let’s take a look at the example.

Data room index example

Consider a scenario where Company A is interested in acquiring Company B. During the due diligence process, both companies decide to use a data room to streamline the exchange of confidential financial, legal, and operational documents.

Once all information is uploaded to the data room, it gets automatically indexed. The data room structures data in a system of main folders and subfolders representing different aspects of Company B’s corporate structure, such as Financial Statements, Legal Contracts, Intellectual Property, and Human Resources. This makes the due diligence process and the forthcoming decision-making much easier for company A, boosting the chances of being acquired for company B as well.

The impact of a well-structured VDR on deal success

The question of how to structure a data room boils down to more than just a visual arrangement of folders. A clear data room index is the backbone that upholds successful business deals thanks to better document organization, more robust access controls, easier searchability, and better security in general. Here’s how:

- Document organization. Precise and logically built due diligence data room structure leads to more efficient and data-driven due diligence.

- Example: In a cross-border merger, a well-structured index with separate folders for each jurisdiction’s legal documents aids legal teams in swiftly accessing pertinent materials, therefore streamlining compliance review.

- Example: In a cross-border merger, a well-structured index with separate folders for each jurisdiction’s legal documents aids legal teams in swiftly accessing pertinent materials, therefore streamlining compliance review.

- Access controls. A well-structured VDR index lets administrators allocate varied access rights based on roles, securing confidential information and mitigating breach risks.

- Example: During an acquisition, potential investors can access financial data, while folders with IP documents can be limited to legal and technical experts via granular VDR access controls.

- Example: During an acquisition, potential investors can access financial data, while folders with IP documents can be limited to legal and technical experts via granular VDR access controls.

- Searchability. Swift information retrieval is essential in vast data repositories — which is made possible thanks to a VDR index’s robust search function.

- Example: In an investment review, quick access to scattered environmental impact assessment documents ensures a comprehensive risk evaluation.

- Example: In an investment review, quick access to scattered environmental impact assessment documents ensures a comprehensive risk evaluation.

- Security. Data security is paramount in sensitive transactions, and a well-structured VDR index enhances secure data organization through encryption, watermarking, restricted printing, and many other means.

- Example: In a confidential IP exchange, the VDR index’s digital rights management prevents unauthorized access, ensuring that folders with sensitive research remain secure.

- Example: In a confidential IP exchange, the VDR index’s digital rights management prevents unauthorized access, ensuring that folders with sensitive research remain secure.

That said, the impact of a well-structured VDR on the success of mergers and acquisitions is significant. Intuitive M&A data room structure serves as a comprehensive, secure, and efficient platform to support and drive the complex process of M&A transactions towards a successful conclusion.

| Elevate your data protection measures and ensure utmost confidentiality with advanced virtual data room security solutions tailored to your business requirements. |

How to structure a digital data room

The clear and logical structure of your data room is the way to keep all documentation organized. Thanks to it, you can make the data room navigation simple and natural for all users.

| Learn how to make data room setup more efficient with proper data room index and permissions adjustments. |

This can only be done with a decent understanding of the company’s business models, internal structure, and other peculiarities. However, the tips below provide a general guide that’s suitable for most data room solutions.

1. Use a document naming system

The first step to proper document management is to apply a unified approach to naming files. This will help your organization set the proper document structure. When all employees follow a single guideline, it is possible to find any document in a matter of clicks.

For better understanding, imagine that your company signs multiple contracts on financial transactions and signs them as “Contract 1” or “Contract 2”. Finding specific contracts by name becomes challenging, and employees waste a ton of time searching for the right papers.

Thus, instead of using “Contract 1” or “Contract 2”, you can set a rule to save contracts in the following format:

- “Vendor A: Supply contract for microchips | 03.20.2022”

- “Vendor B: Supply contract for steel | 01.06.2021”

Although there are no universal naming systems, you can use general information to focus on brevity and clarity. It is a good idea to use metadata like names, dates, and versions. Everything depends on your business’s peculiarities.

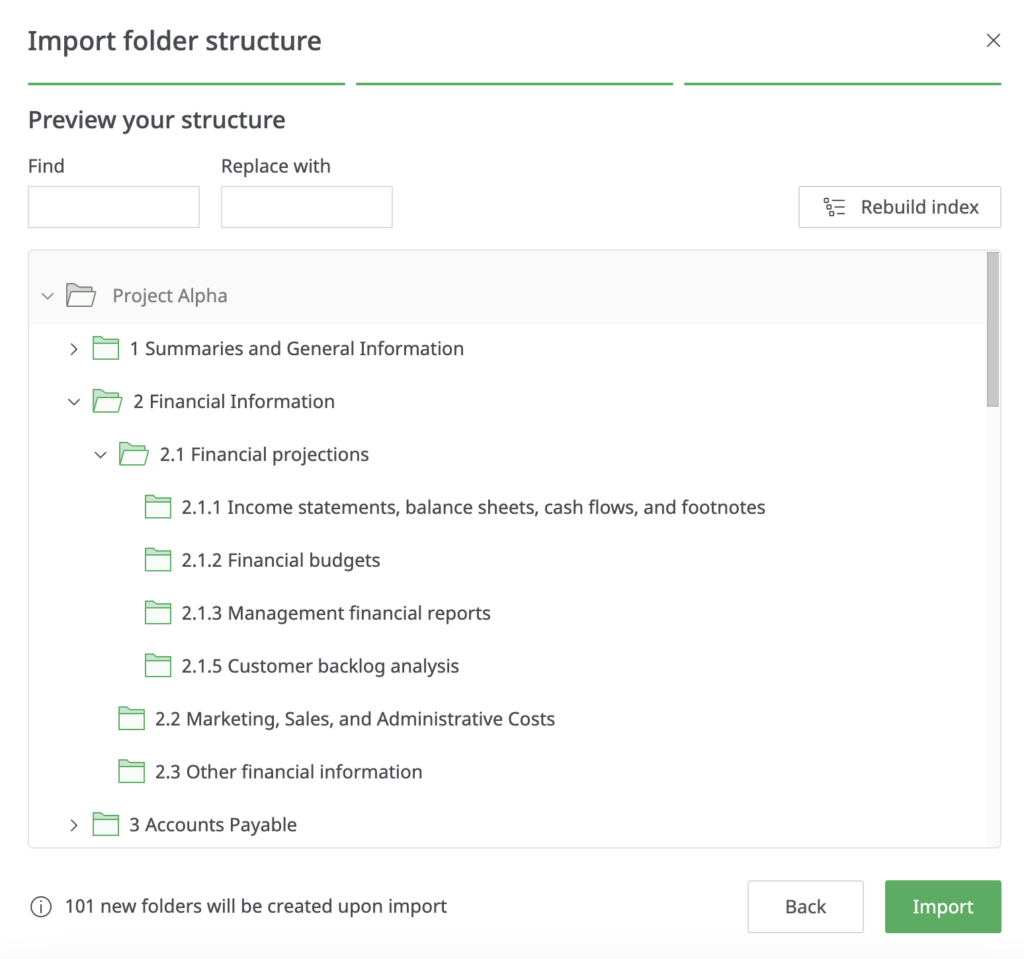

2. Create top-level folders and subfolders

The most reliable way to build a great data room folder structure is to apply top-level folders and subfolders. This feature helps you keep files organized in certain sections, simplifying the search process.

You can have several top-level folders for the following topics:

- Accounting

- Finances

- Legal

- HR, and others

Each top-level folder can contain an unlimited number of subfolders related to a single topic. Thus, a folder named “finances” would generally include contracts, receipts, business transactions, and other similar documents.

Having a proper data room folder structure significantly facilitates the due diligence process. Simultaneously, all team members get to easily find whatever they need on the platform. It is also relevant when speaking of traditional data rooms, which are a bit less popular right now.

3. Set the right access control features

It is likely that your online data room stores multiple files, including sensitive corporate information. That’s why it is necessary to apply certain access control measures to prevent unwanted situations.

For example, most virtual data rooms offer the following features:

- Dynamic watermarking that includes the user’s IP address and email

- View-only access without the possibility to download a file

- Access restrictions to certain files

Additionally, administrators can apply different access levels based on the user’s needs. This approach lets you restrict access to sensitive documents and protect corporate data from accounts that aren’t trustworthy.

With these settings, virtual data rooms simplify file sharing and turn into a completely secure online repository. There are many security layers both internally and externally, so it is very unlikely for key information to be leaked.

4. Prepare and upload your files

Before uploading any files to the data room, prepare documents and ensure that all of them are up-to-date. This may require some additional time, but only relevant information must be used during the M&A due diligence process.

Outdated documentation is useless and may even bring your business extra costs. Unlike in physical data rooms, many online data room providers charge companies for the storage used. That’s why it’s necessary to keep everything relevant.

Once all files are up-to-date, you can upload all documents to the VDR. Some old papers like financial statements or legal agreements may be saved, but it depends on your company’s individual situation. Remember to keep everything structured in relevant folders!

5. Add administrators and users

A virtual deal room must have at least one administrator to monitor the platform. This person gains full access to the VDRs features and tunes the collaboration tools applied. Simultaneously, the administrator can view all sensitive corporate information.

Usually, the best choice is to set your company’s decision-makers as administrators. They understand the business inside-out and already have access to sensitive information, so it is the most reasonable option for data management.

Based on our experience, most data room providers require users to be signed in to view the uploaded documents. That’s why you should add people by using their email addresses. This approach will help you control access and ensure data security.

To further enhance document security, you can apply such features as dynamic watermarking and download restrictions. Almost every provider in the data room industry includes features for protecting confidential data, so you must apply them at all times.

6. Maintain your virtual data rooms

Most organizations work with hundreds of documents, so it is necessary to update them regularly and save only relevant information. Online data rooms are usually used to provide remote access to valuable data, so storing up-to-date info is beneficial for multiple parties.

Some data rooms support synchronization features that allow documents from your PC to be uploaded to the VDR automatically. This is a good option when you have to exchange important documents frequently and want to save time by automating the data sharing process.

Project indexing in your data room software

A project or data index represents the data room’s table of contents. It usually looks like a list of items, helping users to locate any information they need.

Why use indexing for due diligence?

Typically, companies fill their secure cloud storage with a lot of confidential documents and files. This is all required for fast data exchange in a protected environment with maximum speed and efficiency.

Although virtual data rooms simplify the process significantly, the benefits aren’t that noticeable without proper indexing. That’s why indexing is a must. It helps both parties find and share sensitive data in a matter of several clicks.

| Ready to enhance your data management and streamline business transactions? Explore the benefits of a well-structured VDR index and find the right solution for your needs with transparent virtual data room pricing. |

How to index a folder in your data room?

We have already discussed top-tier folders and subfolders. These are essential components of the document management and indexation process within your data room software.

Primarily, you should create several top-tier folders. There should be a limited number of these to improve searchability inside your data room. A lot depends on your business’s situation, but the optimal number is usually up to 10 folders.

The next step is creating sub-folders within the top-tier folders. For example, the “Finances” folders can include the following subfolders:

- Contracts

- Salaries

- Donations, and others

A lot depends on the way your business is set. Having a comprehensible folder structure takes data sharing in your data room software to the next level.

What should you include in the data room index?

You can include various folders in the data room index to make navigation easier. Generally, the most common examples included represent various branches of the company’s corporate structure:

- HR

- Legal

- Intellectual property

- Marketing

- Regulations, and others

Each index folder can be assigned multiple subfolders, helping you create the most user-friendly data room for due diligence.

How to check the size of your data room?

Checking the size of your data room is possible by downloading the project index. You have to follow the same steps described in the previous section. After opening the downloaded file, you will see the:

- Document types

- Document sizes

- Overall size of the data room, and more

Other data rooms can depict the information in a different way. Your virtual data room provider must have a knowledge base and technical support service – check them out to get a solution.

Best practices to organize your data room for due diligence

Based on our observations, organizing documents in a due diligence data room is pivotal for smooth and effective business transactions. Here are several best practices to consider:

- Categorize documents by themes. Organize documents into well-defined categories that align with the various aspects of the transaction. Grouping all the files by themes such as financials, legal contracts, intellectual property, and operational data makes navigation intuitive for all stakeholders.

- Create logical subfolders. Within each category, establish logical subfolders to further channel information. This granularity aids in precise document retrieval and ensures that users can swiftly access the specific details they require.

- Implement clear naming conventions. Adopt consistent and descriptive naming conventions for all the documents. This ensures that stakeholders can quickly understand the content of each file without having to open it, promoting efficiency and reducing confusion.

- Use date and version labeling. Clearly label documents with dates and version numbers. This practice helps users identify the most recent and relevant information, eliminating the potential for outdated or incorrect documents to be reviewed.

- Use indexing and metadata. Attach relevant metadata to documents to provide context and enhance searchability. Indexing key terms, document owners, creation dates, and other pertinent information enables users to retrieve documents based on various criteria.

- Access permissions mapping. Align permission settings with user roles and responsibilities. Grant access only to those who need specific information for their tasks, minimizing the risk of unauthorized data exposure.

By adhering to these best practices, you can ensure that your due diligence data room is organized in a manner that promotes efficiency, security, and informed decision-making throughout the whole transaction process.

Collaborate with the best virtual data room providers!

Now, let’s briefly overview what we’ve learned about data room index and structure:

- A virtual data room index is a structured and efficient file arrangement within a secure platform, guiding authorized stakeholders in high-stakes business processes. It serves as a digital roadmap, enabling efficient data location, review, and analysis and streamlining decision-making.

- Well-structured VDRs guarantee more efficient file organization, access control, searchability, and security, making them crucial for such scenarios as acquisitions, audits, and legal proceedings.

- Best practices for an efficient data room index include categorizing documents, using logical subfolders, clear naming conventions, date and version labeling, indexing metadata, and mapping access permissions.

Consider re-evaluating your current data management strategies for boosting their efficiency and potential outcome on your business performance. Select a data room solution for your business needs out of the best data room providers for data hosting and secure file sharing.

FAQ

What is the best way to structure a virtual data room?

The folder structure is the best way to organize a virtual data room. Build a system of folders and subfolders and arrange it by themes, implement clear naming conventions, use date and version labeling, and map access permissions based on user roles.

How does the structure of a virtual data room impact its usability?

The outlined structure of a virtual data room significantly affects usability by enabling efficient data retrieval, precise navigation, and streamlined collaboration among stakeholders. A well-organized structure enhances due diligence processes and supports informed decision-making.

Can I change the structure of my virtual data room after it’s been set up?

Yes, many virtual data room providers allow you to modify the structure of your data room even after it’s been set up. This flexibility ensures that you can adapt the organization of documents to evolving business needs and transaction requirements.